3 min read

Bessent asks Congress to drop 'retaliatory' tax as Republicans struggle to rewrite bill

Merit Street Media

|

Jun 27, 2025

Merit Street Media

|

Jun 27, 2025

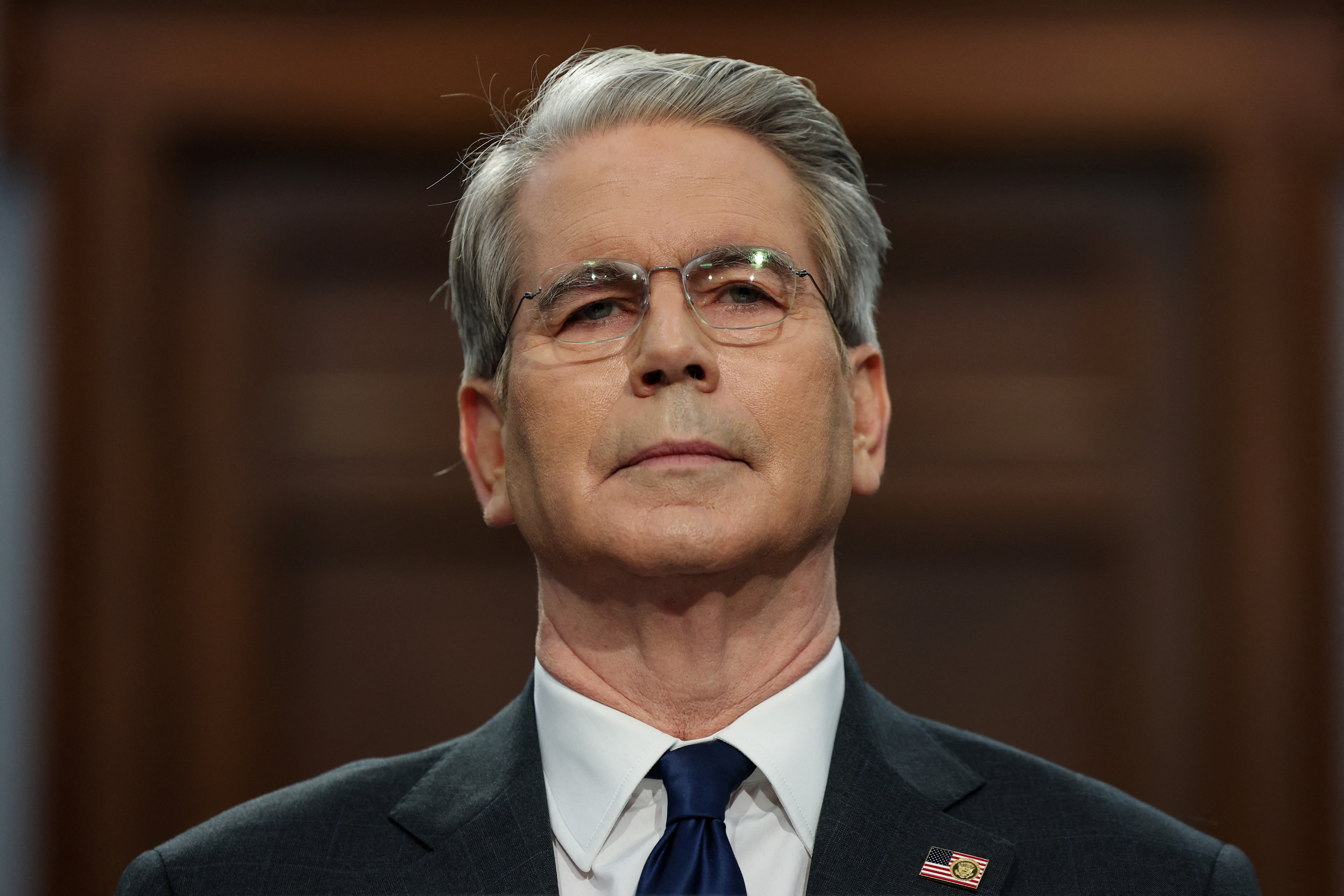

WASHINGTON - U.S. Treasury Secretary Scott Bessent on Thursday asked Republicans in Congress to remove a "retaliatory tax" proposal that targets foreign investors from their sweeping budget legislation, as lawmakers struggled to find a path forward on the bill.

The retaliatory tax proposal has stirred alarm on Wall Street, as fund managers, venture capital firms and others have warned it could disrupt financial markets, which have already been spooked by President Donald Trump's push to impose steep tariffs on top U.S. trading partners.

Known as "Section 899," the proposal would give Trump new authority to impose taxes up to 20% on investors from countries that are found to impose "unfair" taxes on U.S. companies.

At the White House, Trump pushed lawmakers to pass the yet-to-be finalized bill, which would extend his 2017 tax cuts, authorize more spending on border security and the military and add about $3 trillion to the federal government's $36.2 trillion debt.

"This is the ultimate codification of our agenda," Trump said of the bill at an event where he was surrounded by truck drivers, firefighters, ranchers and other workers who the administration says would benefit from the bill.

Asked if he believed Congress could finish its work before the July 4 Independence Day holiday, which Trump has sought for weeks, he replied, "We hope so."

Senate Republicans have yet to produce their version of their legislation ahead of a possible weekend vote, and the overall shape of the bill appeared more uncertain after a nonpartisan referee ruled that several healthcare provisions violated the complex process Republicans are invoking to bypass Democratic opposition.

Those elements collectively represented more than $250 billion in healthcare cuts, according to Democratic Senator Ron Wyden of Oregon. Democrats have lined up against the bill, portraying it as a wasteful giveaway to the wealthiest Americans.

Senate Republicans have spent the last several weeks revising the bill, which passed the House of Representatives by one vote last month. The nonpartisan Congressional Budget Office said the House version would add $2.8 trillion to the debt over the next decade, when factoring in its economic effects, and noted the toll would rise to $3.4 trillion when accounting for interest expenses.

BILL PROSPECTS UNCLEAR

It was unclear on Thursday whether Republicans could opt to rework the bill to comply with the complex budget rules, as they have already done with some elements, or seek to override the decision by the Senate parliamentarian.

"It's pretty frustrating. But you know, what we've got to do is work through this process and come up with something that you know, fulfills the Trump agenda and also has fiscal sanity,” Senator Rick Scott, a Florida Republican, told reporters.

The bill encompasses much of Trump's domestic agenda. It would extend his 2017 tax cuts, boost immigration enforcement, zero out green-energy incentives and tighten food and health safety-net programs. Nonpartisan analysts say the bill would effectively shift wealth from younger Americans to the elderly.

DEBT DEADLINE AHEAD

While Trump has called on Congress to finish its work by July 4 deadline, lawmakers face a far more significant deadline later this summer, when they need to raise their self-imposed debt ceiling or risk triggering a catastrophic default.

Republicans who control both chambers of Congress broadly support the package, but they can afford to lose no more than three votes in either chamber. They remain at odds over several provisions -- notably a proposed tax break for state and local tax payments and a tax on healthcare providers that some states use to boost the federal government's contribution to the Medicaid health plan.

The bill would limit those "provider taxes," which nonpartisan watchdogs portray as an accounting trick that drives up Medicaid costs. Rural hospitals and other health providers warn that those cuts could force them to scale back operations or go out of business, and some Senate Republicans have sought to soften that provision.

The provider tax is one of several health and education provisions that has been ruled out of bounds by the Senate parliamentarian, creating further uncertainty about its status.

"This would be a chance to get it right and to protect rural hospitals," said Republican Senator Josh Hawley of Missouri, a critic of the provider-tax restrictions.

The parliamentarian also flagged provisions that would deny student aid and Medicaid health coverage to some immigrants, as well as a provision that would prohibit Medicaid funding for transgender medical care.

Senate Republican Leader John Thune said Republicans will not try to overturn the parliamentarian's rulings.

Copyright Reuters